EA's share price soared 15% on Friday local time after the Wall Street Journal revealed that EA would reach a privatization deal worth $50 billion.With the rise in stock prices on Friday, EA has accumulated a cumulative increase of about 32% so far this year.

Investors including Saudi Arabia's Public Investment Fund (PIF) and private equity firm Silver Lake may announce the deal as soon as next week, the report said.PIF has made huge investments in the gaming field in recent years, and has acquired the developer of "Pokemon" and the parent company of "Monopoly Go".

Global investors drive the largest leveraged buyout in history

If finalized, the deal would be more than just a normal acquisition, but the largest leveraged acquisition (LBO) in Wall Street's history, surpassing TXU Energy's record of $45 billion in 2007.In leveraged acquisitions, buyers use a lot of debt to complete the acquisition, a common practice in private equity firms, with the aim of maximizing returns with limited self-owned capital.The huge scale of the proposed transaction has already caused shock in the financial and gaming worlds.

Saudi Public Investment Fund (PIF) has been actively expanding its gaming landscape in recent years.Recent acquisitions of the companies behind popular global games such as Pokémon Go and Monopoly Go show their strategy to gain influence in the interactive entertainment field.Silver Lake, which has long been deeply involved in technology and media investment, has brought more professionalism and financial strength to this transaction.

EA's ace game and market momentum

EA has always been a regular visitor to headlines.The company has created a number of world-renowned game series: The Sims, Madden NFL, and the football game FC (formerly FIFA), shaping the memories of generations of players.The diversified combination of sports, simulation and strategy has made EA not only a household name, but also a gold target for capital pursuit.

At this time, news of privatization was reported, which was quite meaningful.As stock prices soared on Friday, EA has risen by about 32% this year.Against the backdrop of accelerated integration of the global game industry and continued capital influx, investors have long paid great attention.EA's robust performance and rich IP combination make it an ideal candidate for privatization, especially as global funds seek more entry points to enter the entertainment and digital economy.

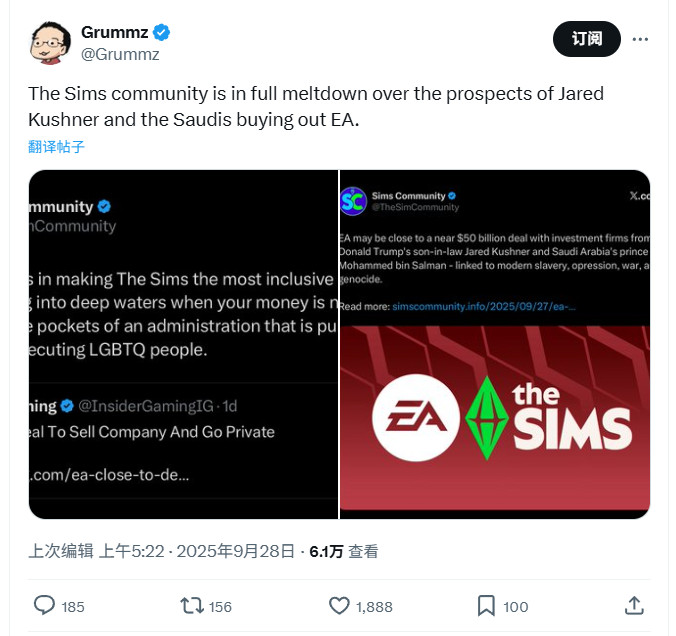

This news completely collapsed the Sims player community

An unprecedented deal may reshape the gaming industry

The $50 billion acquisition has a profound potential impact.First, privatizing EA can help it get rid of the pressure of quarterly financial reports and shareholder public opinion, allowing EA management (including CEO Andrew Wilson) to be more free to advance long-term strategies, invest in emerging technologies, and potentially expand its IP without the constraints of the capital market.

But the question still exists.Will high debt weaken EA's ability to innovate or cope with lows? What does this mean for employees, partners, and millions of players relying on EA's gaming entertainment? Although EA has not commented yet, the heat on the deal has been high, and market observers have begun to debate the potential direction.

Wall Street has never lacked huge mergers and acquisitions, but this transaction is unique due to its scale and international characteristics.Funding participation from the Middle East, the United States and even other regions means that the gaming industry is evolving into a global asset class, with its influence and return potential comparable to traditional media, sports and technology industries.

Industry and market reactions

Market analysts have different opinions.Some believe that the move is a bold bet on the future of interactive entertainment—private capital is willing to take risks that open market shareholders may avoid.Others warn that leveraged trading could bring volatility, especially as gaming revenues slow or regulatory scrutiny intensifies.

"This is not just a financial operation, but also an announcement of the flow of global capital." A Reuters analyst commented. "Game is no longer a niche, it has become a core part of the lives and consumption of billions of people."

Competitors and partners are also highly concerned.According to Seeking Alpha, companies such as Take-Two Interactive and Playtika may be subject to a chain reaction. As integration accelerates, small and medium-sized studios and publishers are facing new tests of capital, issuance channels and creative autonomy.

Looking ahead: What's next for EA?

The next few days are crucial.According to sources, there may be an official announcement as early as next week.If the deal is reached, EA will usher in a new chapter - privatization, strategic reshaping, and a new positioning possible relationship with players.

At present, investors, employees and fans can only continue to speculate: will this deal bring a new round of growth, or will it introduce new risks? Will EA's creative spirit develop freely outside the spotlight, or will it be restricted by debt pressure and new owners? These questions are still unanswered, but the market is celebrating a record-breaking stock price surge.